Today I signed a letter authored by two economists with opposite political affiliations (Larry Summers and Phil Gramm.) Their letter states the case (to Congress) for opposing the use of tariffs as a general tool for economic policy. Two snippets from their letter close this posting.

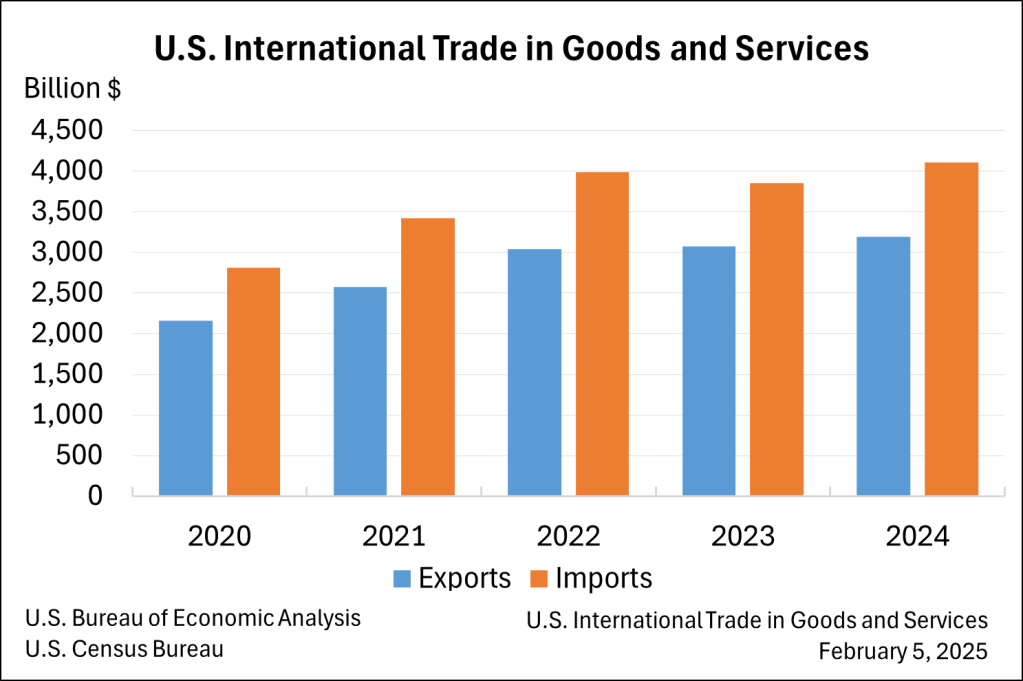

In my previous posting on the proposed Trump tariffs, I did not address the implications for foreign holdings of US Treasuries. Such holdings increase naturally as a result of a country running both governmental budget and trade (see above graphic) deficits in the aggregate. In short, for given exchange rates and domestic savings roughly equal to domestic investment, trade deficits must be funded by the inflow of foreign capital. For the US, this has meant the purchase of both private and public securities (treasuries); thus, a decline in the trade deficit is likely to lead to reduced demand for both dollars and treasuries. One consequence could be a rise in interest rates in the US.

Here’s why. Accounting rules require that the sources of income for a particular country must equal the uses of such income. See equation 1:

Sources of income = Uses of income

(1) C + I + G + X = C + S + T + iM

National income accounting defines the sources of income as the sum of consumption (C), investment (I), government purchases net of transfers (G), and exports (X). The uses of such income consist of consumption, private savings (S), taxes net of transfers (T), and the purchase of imports (iM). The above accounting identity (1) can be rearranged to yield equation 2:

(2) (S – I) + (T-G) + (iM-X) = 0

If private savings exceed gross domestic investment and net public savings (T-G) are negative, then, by definition, imports must exceed exports. Thus, domestic entities would pay for these net imports with the transfer of the ownership of domestic assets to foreign holders. For private investment greater than private domestic savings, the ownership of the title of such assets would transfer abroad. For government purchases in excess of the net taxes available to cover them, treasuries would be sold to and held by foreign entities. Thus, equation 2 can be restated as equation 3, the sum of net private, public, and foreign savings.

(3) Sp + Sg + Sf =0.

Thus, if the first two are negative, the third term (Sf), the net inflow of foreign capital (or the purchase of domestic assets by foreigners) into the domestic economy must be positive.

Why does this matter? As Harold James argues in a January 27, 2025 Project Syndicate piece, countries that do not generate sufficient savings to pay for their purchases, must import savings to make up the difference. Contemporary details for the US will be described below. The key point is that if tariffs reduce imports sufficiently, that is, enough to exceed the rise in domestic currency that would make imports cheaper, then the demand for domestic assets, especially treasuries, would fall and so would their prices. Since debt prices would fall, to attract holders, the interest rates on such debt would have to rise.

James points out that “The country imports savings from the rest of the world to pay for its trade deficit. If it did not, Americans would have to consume less, which would be experienced as a decline in their standard of living.” Thus, it is ironic that “higher tariffs jeopardize this arrangement because the US needs foreign investment (capital inflows/savings) to drive its future growth.”

If (when?) foreign entities retaliate against US exports, then both imports and exports would decline. Since exports of both domestic and foreign entities are sources of income, global income would decline. In short, US tariffs, rather than increase the strength of the American economy, might yield declines in both the income of Americans and their trading partners.

Based on data available at the Bureau of Economic Analysis and the US Treasury Department , the table below reveals that approximately $700 B of foreign capital would be needed to pay for aggregate US spending last year.

| Net Domestic Savings | Net Private Savings | Net Government Savings | Trade Deficit | Needed Foreign Savings |

| $223.1 B | $1951.1 B | -$1,728.0 B | $918.4B | $695.3 B |

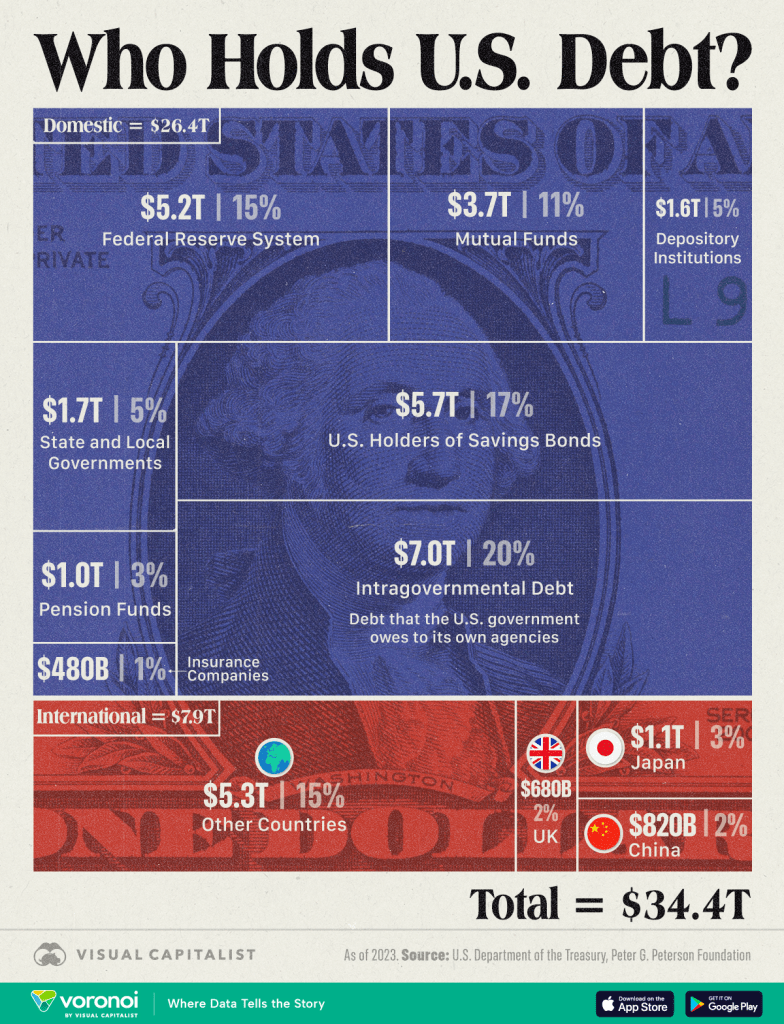

According to the most recent annual report by the US Department of Treasury (information as of June 30, 2023), of the $132 trillion of US securities, foreign entities held 20%. Of the $22.9 trillion of US securities not held in US government accounts (such as for Social Security, Veterans Benefits, the Federal Reserve system, and various state and local governments), almost one-third ($7.6 trillion) is held by foreign entities. The graphic provides some relevant details.

Summers and Gramm’s letter to Congress contains the following two paragraphs. I encourage everyone to read the full letter.

Protective tariffs distort domestic production by inducing domestic producers to commit labor and capital to produce goods and services that could have been acquired more cheaply on the international market. That labor and capital are in turn diverted from producing goods and services that couldn’t be acquired more cheaply internationally. In the process, productivity, wages and economic growth fall while prices rise. Tariffs and the retaliation they bring also poison our economic and security alliances.

In the long history of the country, there is little evidence to substantiate the claim that America prospers more when trade deficits fall than it does when they rise.