Last week, Tom Content, the executive director of the Citizens Utility Board of Wisconsin, addressed a local Sierra Club group on the subject of how the Wisconsin’s Public Service Commission (PSC) considers requests for data center energy use. He encouraged the audience to submit comments to the PSC by Tuesday, February 17th. Below you will find what I submitted in response.

Comment for Public Service Commission hearing on data center cases under dockets 6630-TE – 113 and 115

Data centers require vast amounts of energy. Such requirements imply the building of new facilities to generate the required power. Before approving new rates or facilities, the Public Service Commission should be asking the following:

1. Who will pay for the initial cost of these new facilities?

2. How will the energy bills of residents be affected?

3. Who will bear the financial risk if these facilities lose money?

As an economist, I would encourage a systemic look at the effects of the increased demand for electricity rather than solely at each individual case. My answers (below) to these three questions suggest that rate payers not pay for the energy demand generated by the proposed data centers.

In response to the first question, the PSC should not be raising consumer prices because of how a utility chooses to fund its capital spending. The return on assets (the weighted average of equity and debt) should be limited to what the market would provide to such utilities. The return on assets for four major electrical utilities (Xcel, Public Services Enterprise Group, WEC Energy Group, and Duke Energy – all with market capitalization in excess of $35 billion) have averaged between 4.5 and 6.5% per year over the past decade (according to Value Line reports). The largest of the four (Duke Energy) has retained its profitability and consistently increased its dividend to 3.6% at present while facing a weighted average cost of capital between 4 and 5% over the past decade. Under normal circumstances – unlike the cases under consideration – rates should not rise by more than 5% to cover new facilities.

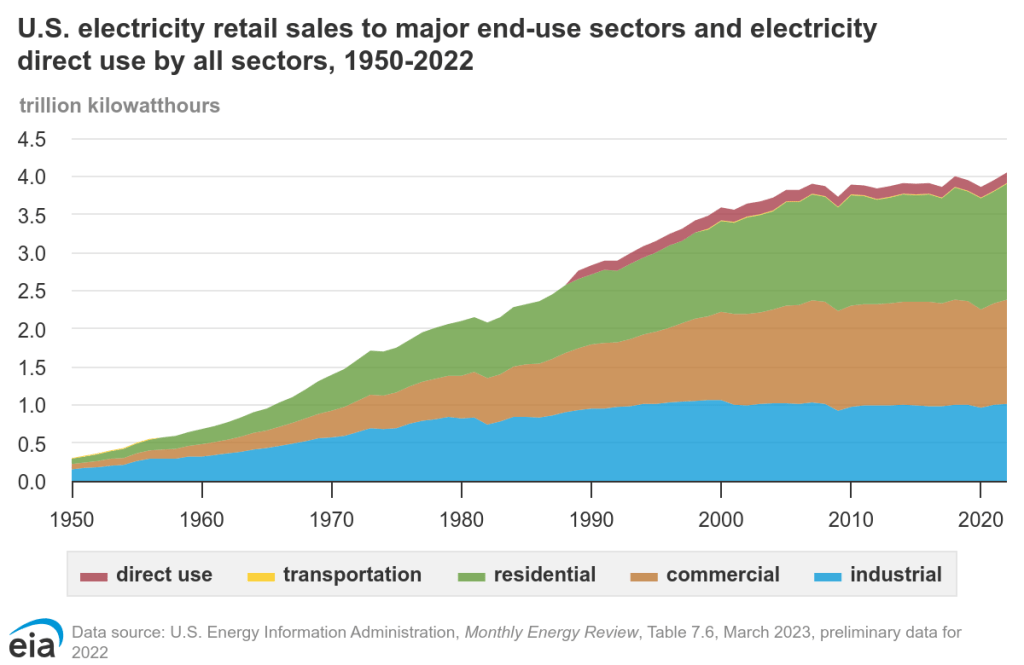

Since electrical power consumption has been relatively flat over the past two decades – see the graph above, the vast proportion of growth in such use will arise from the aforementioned data centers. These centers and the major AI users should bear the cost of such an expansion. In the words of Morningstar’s Sarah Hansen in a January 30, 2026 report: “Power bills are no big deal for big tech.” So, my answer to the second question is that residents and businesses that are not major users of AI users should not see any rate increase.

Finally, in the response to the third question, capital markets are designed to incorporate risk into the price of capital; thus, if the investments in new facilities turn out to not be financially viable that should have been taken into account by those who provided the funding.